PCI DSS for Call Centres

How to Achieve PCI-DSS Compliance in a Call Centre

PCI-DSS is the abbreviated form of the Payment Card Industry Data Security Standard.

It refers to an actionable framework for robust payment card data security processes, including the prevention and detection of credit misuse and fraud.

Developed by the PCI Security Standards Council, the PCI-DSS guidelines refer directly to how PCI-DSS applies to call centres in Australia and worldwide.

What does PCI-DSS technology in call centres actually do?

One of the main objectives in call centre technology to help achieve PCI-DSS compliance is blocking the storage of any credit card information captured during call recordings between a customer and a call centre agent.

As most call centres record ALL calls, this can be a little problematic.

The PCI-DSS call centre technology's role is to essentially automate that process, however, there are a number of different approaches that different vendors are using including:

- Automatically blanking out details on any screen recordings.

- Automatically wiping/redacting credit card information from call recordings.

- Providing alternative technology solutions for payments, e.g., transferring the customer to a secure PCI-DSS compliant payment engine to complete their credit card transaction; once it's completed, the customer is returned to the call centre agent.

One of the other options is to avoid recording the credit card payment details in the first place.

Many contact centre technology solutions enable call centre agents to pause the recording during credit card payments.

While this can be effective, it's a manual process that, therefore, is prone to error and misuse.

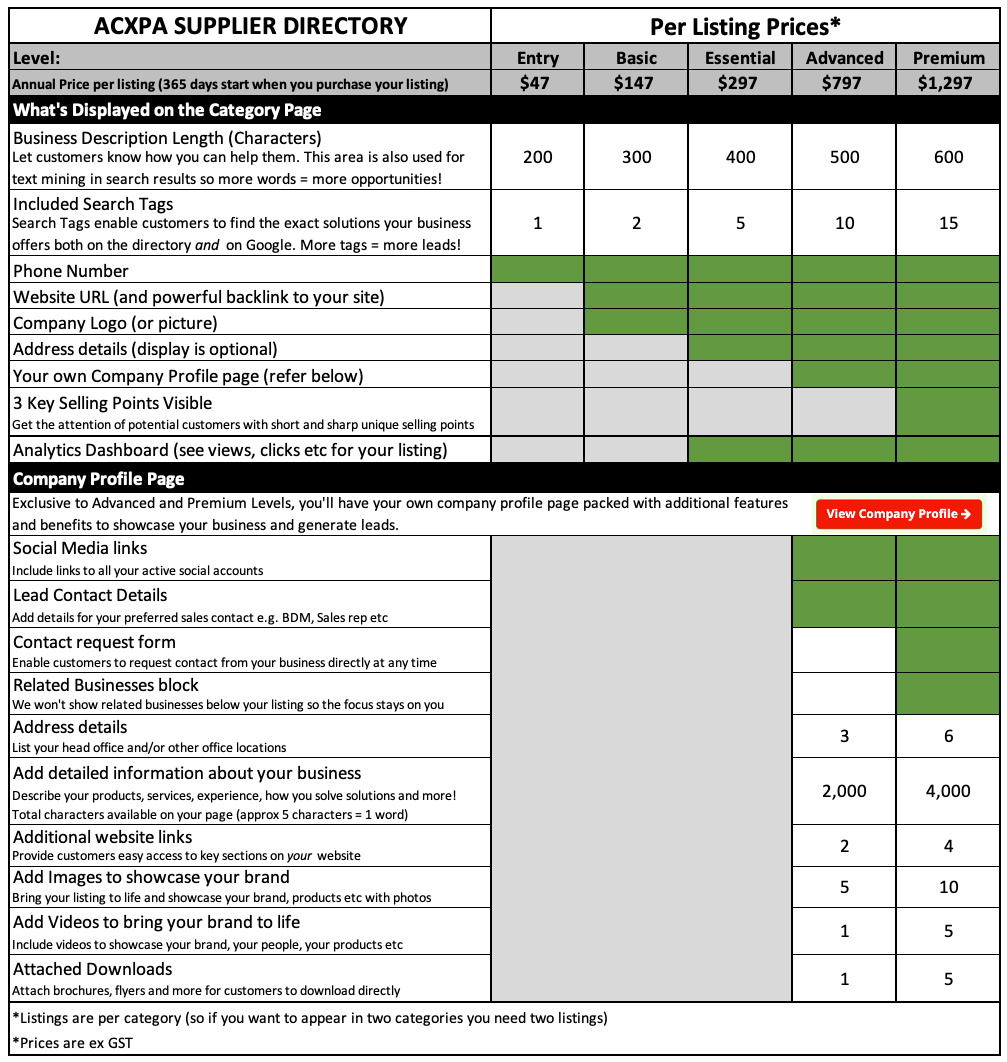

The vendors below are specialists in helping call centres achieve PCI-DSS compliance so the best advice is to contact them directly for the right advice on what's best for your contact centre and industry vertical.

Search Suppliers of PCI-DSS for Call Centres

Contact the call centre technology vendors below or use the search filters to find vendors with other contact centre solutions.